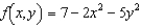

Find and simplify the function  at the given value

at the given value  .

.

Definitions:

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual amounts, making it the simplest depreciation method.

After-Tax Discount

The reduction in price or value of an item after taxes have been factored into its cost.

Income Tax Rate

The percentage of income that is paid to the government as tax. It can vary depending on the income level and jurisdiction.

Straight-Line Depreciation

An approach to spreading out the expense associated with a long-term asset evenly over the period it is expected to be used.

Q1: Examine the function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4584/.jpg" alt="Examine the

Q3: Find a power series for the function

Q5: Find the limit. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4584/.jpg" alt="Find the

Q9: Evaluate the following improper integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4584/.jpg"

Q9: Use the Limit Comparison Test to determine

Q13: The position vector <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4584/.jpg" alt="The position

Q17: Represent the following curve by a vector-valued

Q17: Given <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4584/.jpg" alt="Given ,

Q18: Use the Direct Comparison Test (if possible)

Q19: Rewrite the iterated integral <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4584/.jpg" alt="Rewrite