Consider the following to answer the question(s) below:

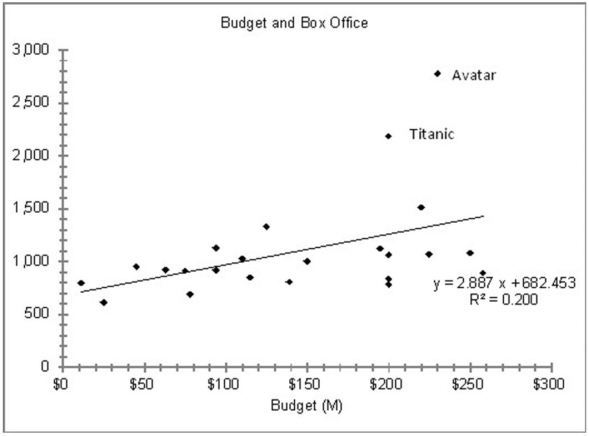

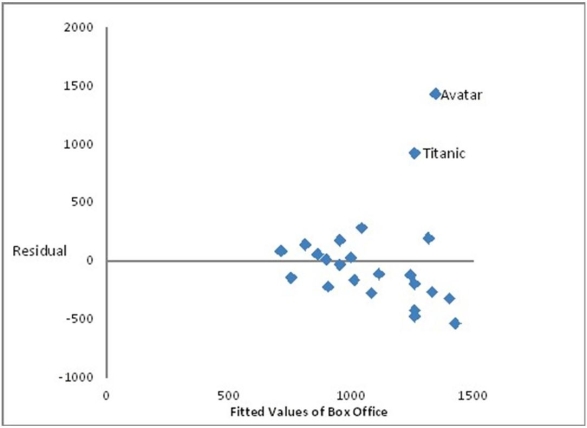

Consider the following scatter diagram for 24 of the top grossing movies of all time. The data include the highest grossing films for which world box office receipts and budgets were available. The top two were Avatar and Titanic.

-What does the plot of the residuals and the fitted values suggest?

Definitions:

Meal Plan

A prepaid system for purchasing meals, often used in college dining halls or by individuals planning dietary needs.

Child Tax Credit

A tax benefit that allows taxpayers to reduce their tax liability on a dollar-for-dollar basis for each qualifying child under a certain age.

AGI

Adjusted Gross Income, which is total income minus specific deductions, used to determine tax liability.

Adoption Credit

A tax credit offered by the IRS to offset some expenses involved in the legal adoption of a child.

Q3: Which of the following re-expressions of the

Q6: The greatest integer function is defined by

Q8: What is the associated P-value?

Q11: Suppose the Wilcoxon signed-rank test was used

Q15: The city of Halifax has determined that

Q19: What type of variable is the style

Q21: Which of the following statements about this

Q31: Based on the F-statistic and associated P-value,

Q32: At the 0.05 level of significance, the

Q66: Find the points of intersection of the