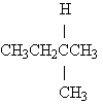

Name the following:

Definitions:

Depreciation Expense

The structured spreading of the expense associated with a tangible asset across its useful life.

Double Declining-Balance Method

An accelerated depreciation method that computes an asset's depreciation at double the rate of the straight-line method over its useful life.

Straight-Line Method

A method of depreciation that allocates an equal amount of the cost of an asset over its useful life.

Depreciation Expense

The allocated amount of an asset's cost charged to expense over time, reflecting the loss in value as the asset is used in operations.

Q14: Which of the following is not a

Q27: You have 88.6 mL of a 2.50

Q31: The heat of formation of Fe<sub>2</sub>O<sub>3</sub>(s)is

Q37: What is the electron configuration of the

Q52: Which of the following would represent the

Q64: The following reactions: <br>Pb<sup>2+</sup> + 2I<sup>-</sup><sup>

Q65: What is the specific heat capacity of

Q72: Which group contains two elements that exhibit

Q79: What is the coefficient for oxygen

Q114: According to crystal field theory,how many unpaired