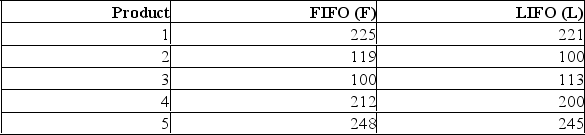

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?

What is the null hypothesis?

Definitions:

Epiphyseal Plate

A layer of cartilage located at the end of long bones that is responsible for the longitudinal growth of bones during childhood and adolescence.

Bone Growth

Bone growth refers to the process by which bones increase in size, including lengthening during childhood and adolescence and changing in density and strength throughout life.

Epiphysis

The end part of a long bone, which is initially separated from the main bone by a growth plate, but later fuses with it.

Appositional Bone Growth

The process by which bones increase in diameter and thickness through the addition of bone tissue at the surface.

Q29: An accounting firm is planning for the

Q48: The following correlations were computed as part

Q75: Suppose we select every fifth invoice in

Q83: What is the chart called when the

Q86: When a confidence interval for a population

Q90: To compare the effect of weather

Q112: If an employee wanted to investigate the

Q114: i. A scatter diagram is a chart

Q117: Based on the Nielsen ratings, the

Q118: i. To prevent bias, the level