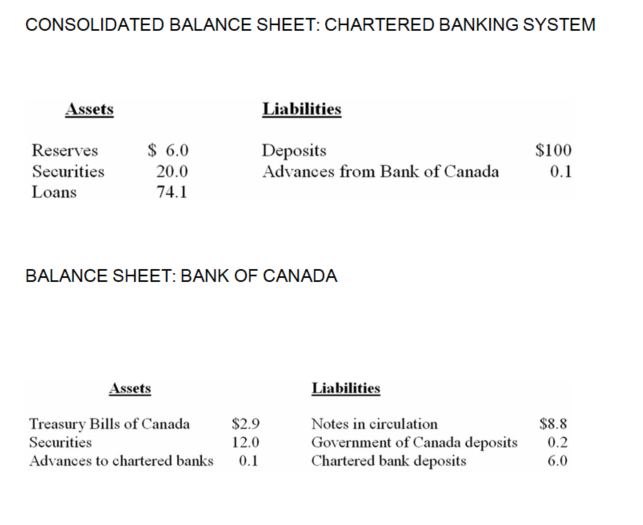

The following is a simplified consolidated balance sheet for the chartered banking system and the Bank of Canada. Assume a desired reserve ratio of 5 percent for the chartered banks. All figures are in billions of dollars.

-Refer to the above information,suppose the Bank of Canada sells $2 in securities directly to the chartered banks.As a result of this transaction,the supply of money:

Definitions:

Quantity Demanded

The total amount of a good or service that consumers are willing and able to purchase at a given price in a given time period.

Quantity Supplied

The amount of a good or service that producers are willing to sell at a particular price.

Price Ceiling

A government-imposed limit on the price charged for a product, intended to prevent prices from rising too high.

Producer Surplus

The difference between what producers are willing to accept for a good versus what they actually receive, often due to market prices being higher.

Q7: A basic criticism of supply-side economics is

Q36: Refer to the above information. Alpha should

Q69: In the short run, demand-pull inflation will

Q100: Refer to the above graph. The long-run

Q108: In the Bank of Canada's consolidated balance

Q116: Refer to the above diagram. Assume that

Q118: The two main tools of the monetary

Q169: The monetary authorities can influence the money

Q216: Refer to the above data. If a

Q230: Mortgage-backed securities are:<br>A) stocks backed by mortgage