Exhibit 3.4

The following questions are based on this problem and accompanying Excel windows.

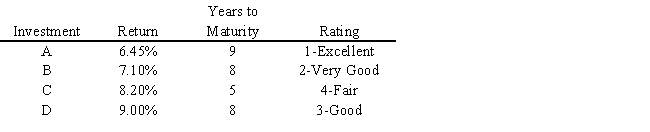

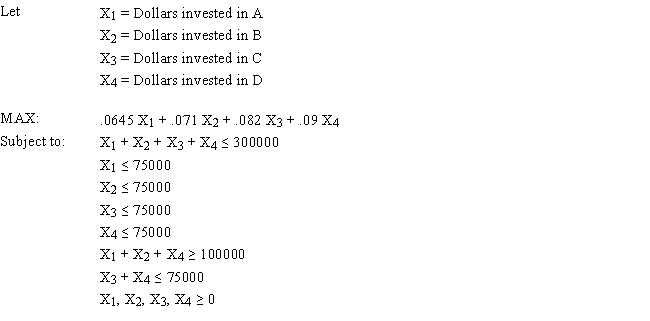

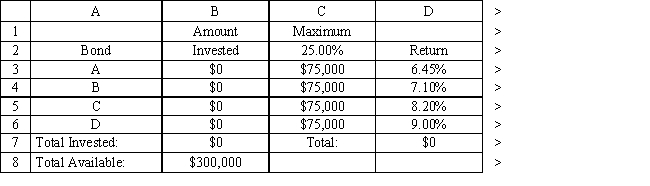

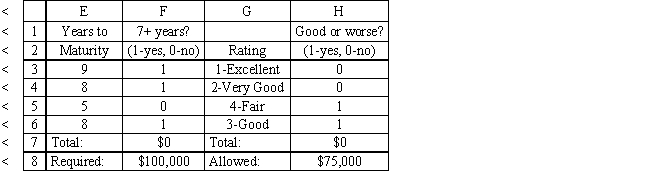

A financial planner wants to design a portfolio of investments for a client. The client has $300,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 25% of the money in any one investment, at least one third should be invested in long-term bonds which mature in seven or more years, and no more than 25% of the total money should be invested in C or D since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio.

-Refer to Exhibit 3.4. What formula should be entered in cell D7 in the accompanying Excel spreadsheet to compute the total return?

Definitions:

Exploitation

The act of using resources or individuals for one's own advantage or profit, often without fair compensation or regard for their well-being.

Mechanistic Structure

An organizational framework characterized by a high degree of formalization, complexity, and centralization in decision-making.

Organizational Cycles

The recurring patterns and phases of growth, change, and development that organizations experience over time.

Life Cycles

The various stages of development and growth that an organism or entity (e.g., a product, an organization) goes through from inception to termination or renewal.

Q10: The allowable increase for a constraint is<br>A)

Q10: In a model Y=f(x<sub>1</sub>, x<sub>2</sub>), Y is

Q31: There are a variety of problems a

Q42: A cellular phone company wants to locate

Q50: The following linear programming problem has been

Q52: Solve the following LP problem graphically using

Q52: The total annual cost for the economic

Q70: Which of the following are potential pitfalls

Q74: The essence of decision analysis is:<br>A) breaking

Q91: Refer to Exhibit 3.3. Which cells should