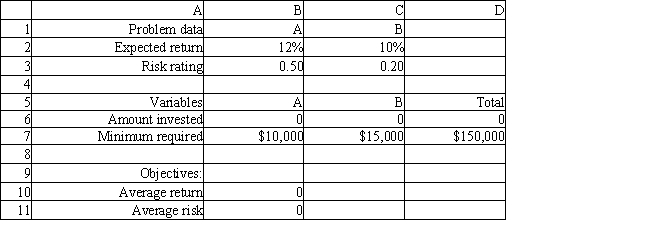

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B. Investment A requires a $10,000 minimum investment, pays a return of 12% and has a risk factor of .50. Investment B requires a $15,000 minimum investment, pays a return of 10% and has a risk factor of .20. The investor wants to maximize the return while minimizing the risk of the portfolio. The following multi-objective linear programming (MOLP) has been solved in Excel.

-Refer to Exhibit 7.2. Which cell(s) is(are) the target cells in this model?

Definitions:

Carrying Value

The book value of assets and liabilities as represented on the balance sheet, considering factors like depreciation or amortization.

Recoverable Amount

The recoverable amount is the greater value between an asset's net selling price and its value in use, indicating the potential value that can be recovered from an asset over time.

Impairment Loss

A reduction in the recoverable amount of a fixed asset or goodwill below its book value, recognized as an expense in the income statement.

Profit Margin

The percentage of revenue that remains after all operating expenses, taxes, and costs have been deducted from total sales.

Q6: An investor wants to invest $50,000 in

Q6: Refer to Exhibit 3.2. What formula should

Q20: Rounding the LP relaxation solution up or

Q26: The setup cost incurred in preparing a

Q36: A node which can both send to

Q39: A production company wants to ensure that

Q46: Pure IP formulation requires that:<br>A) all decision

Q47: The general form of an extrapolation model

Q85: An oil company wants to produce lube

Q119: Refer to Exhibit 10.1. The university has