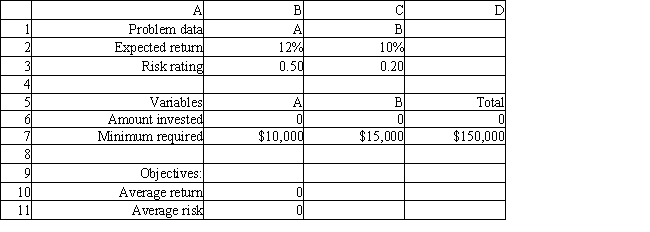

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B. Investment A requires a $10,000 minimum investment, pays a return of 12% and has a risk factor of .50. Investment B requires a $15,000 minimum investment, pays a return of 10% and has a risk factor of .20. The investor wants to maximize the return while minimizing the risk of the portfolio. The following multi-objective linear programming (MOLP) has been solved in Excel.

-Refer to Exhibit 7.2. What formula goes in cell B11?

Definitions:

Simple Rate Of Return

A financial metric that calculates the increase in profits or savings expected from an investment as a percentage of the initial investment cost.

Annual Cost Savings

The reduction in costs achieved during a fiscal year, enhancing the organization's profitability.

Discount Rate

This rate is applied within discounted cash flow analysis to determine the contemporary monetary worth of future cash movements.

Investment Required

The total amount of capital needed to undertake a project, investment, or start a business.

Q10: In general there are two primary issues

Q17: Refer to Exhibit 11.16. What is the

Q43: Suppose that a data set contains a

Q46: Bob and Dora Sweet wish to start

Q47: Refer to Exhibit 10.1. What percentage of

Q57: A MINIMAX objective function in goal programming

Q58: The allowable increase for a changing cell

Q61: In a model Y=f(x<sub>1</sub>, x<sub>2</sub>), x<sub>1</sub> is

Q101: Refer to Exhibit 11.24. Based on the

Q113: A graphical representation of a set of