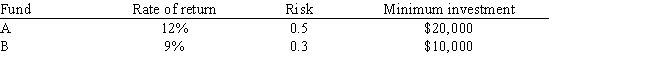

An investor wants to invest $50,000 in two mutual funds, A and B. The rates of return, risks and minimum investment requirements for each fund are:  Note that a low Risk rating means a less risky investment. The investor wants to maximize the expected rate of return while minimizing his risk. Any money beyond the minimum investment requirements can be invested in either fund. The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

Note that a low Risk rating means a less risky investment. The investor wants to maximize the expected rate of return while minimizing his risk. Any money beyond the minimum investment requirements can be invested in either fund. The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

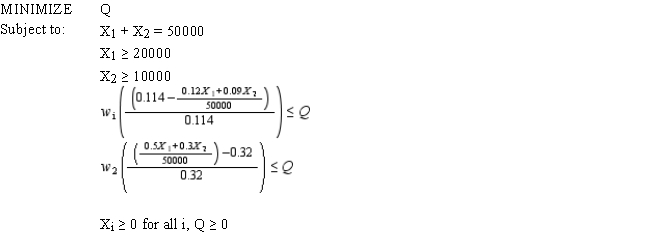

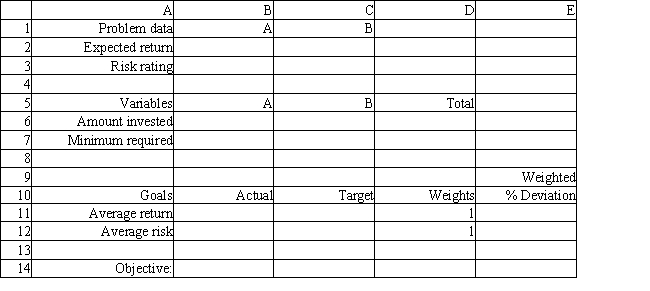

The following Excel spreadsheet has been created to solve a goal programming problem with a MINIMAX objective based on the following goal programming formulation with MINIMAX objective and corresponding solution.  with solution (X1, X2) = (15,370, 34,630).

with solution (X1, X2) = (15,370, 34,630).

What values should go in cells B2:D14 of the spreadsheet?

Definitions:

Information

Data that is processed, organized, or structured in a way that is meaningful or useful to those who receive or use it, often facilitating decision-making or problem-solving.

Property Issues

Concerns or disputes related to the ownership, use, and rights over physical or intellectual property.

Consequences

The outcomes or results that directly follow from an action or decision, whether they are intended or unintended.

Accountability

The obligation of an individual or organization to account for its activities, accept responsibility for them, and to disclose the results in a transparent manner.

Q14: The feasible region for the pure ILP

Q16: _ is a classification technique that estimates

Q25: The supply nodes in the graphical representation

Q52: The total annual cost for the economic

Q60: Solve the following LP problem graphically using

Q62: Data mining tasks fall in the following

Q70: A random variable is<br>A) a variable whose

Q73: In a transshipment problem, which of the

Q90: You have been given the following linear

Q109: Refer to Exhibit 11.9. What are predicted