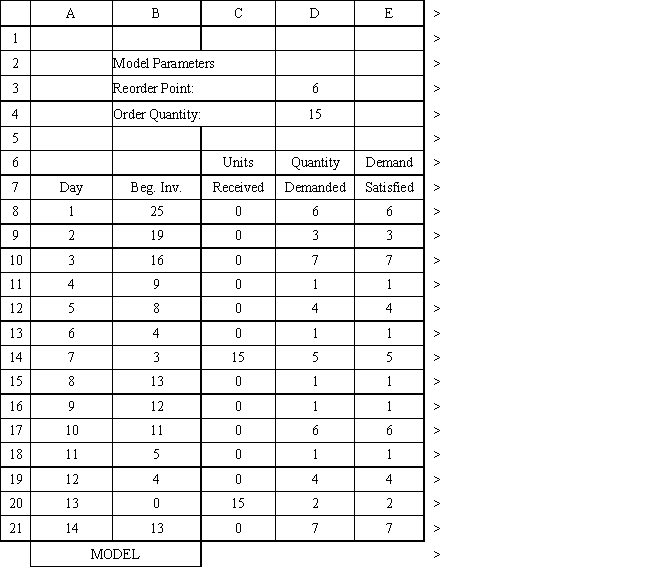

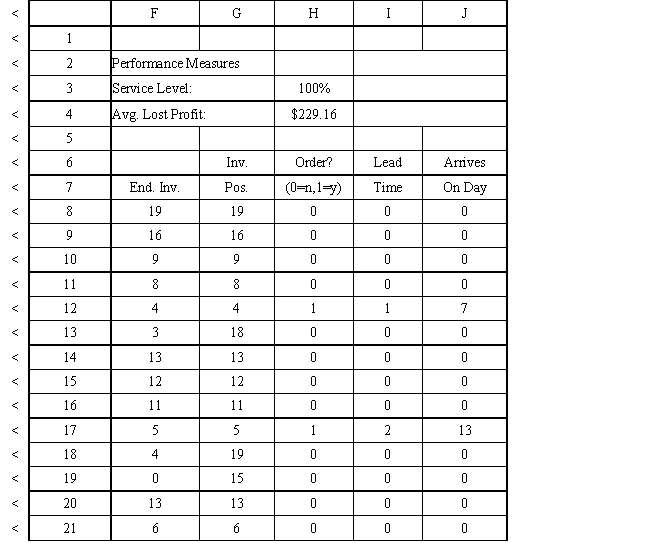

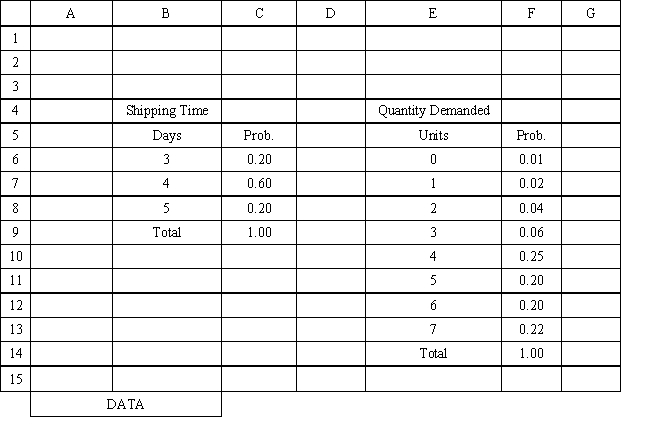

Exhibit 12.3

The following questions use the information below.

An auto parts store wants to simulate its inventory system for engine oil. The company has collected data on the shipping time for oil and the daily demand for cases of oil. A case of oil generates a $10 profit. Customers can buy oil at any auto parts store so there are no backorders (the company loses the sale and profit) . The company orders 30 cases whenever the inventory position falls below the reorder point of 15 cases. Orders are placed at the beginning of the day and delivered at the beginning of the day so the oil is available on the arrival day. An average service level of 99% is desired. The following spreadsheets have been developed for this problem. The company has simulated 2 weeks of operation for their inventory system. The current level of on-hand inventory is 25 units and no orders are pending.

-Using the information in Exhibit 12.3, what formula should go in cell G9 to compute inventory position?

Definitions:

Risk-Loving Investors

Investors who prefer investments with higher levels of risk in anticipation of potentially higher returns.

Utility Function

A mathematical representation of how a consumer derives satisfaction from consuming goods or services, showing their preferences.

Aversion to Risk

The inclination to avoid taking risks, preferring safer or more certain outcomes over uncertain ones.

Risk Neutral

An investor who finds the level of risk irrelevant and considers only the expected return of risk prospects.

Q5: Other terrible consequences of rape can include

Q9: Affinity analysis is a data mining technique

Q16: The main difference between shadow prices and

Q53: Refer to Exhibit 8.1. What formula is

Q62: Suppose that the regrets for an alternative

Q80: What is the formula for P(t ≤

Q91: A "risk averse" decision maker assigns the

Q95: A circular node in a decision tree

Q117: In a graphical representation of decision trees

Q120: Refer to Exhibit 11.10. What is the