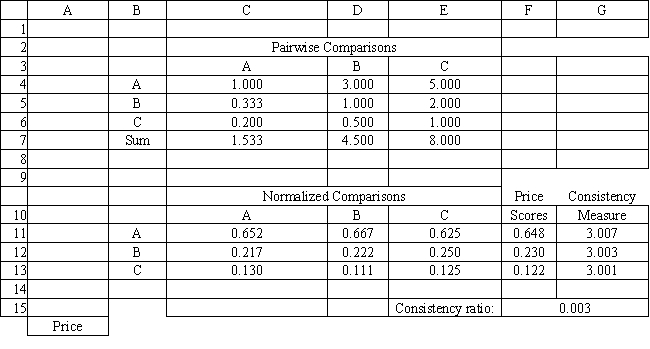

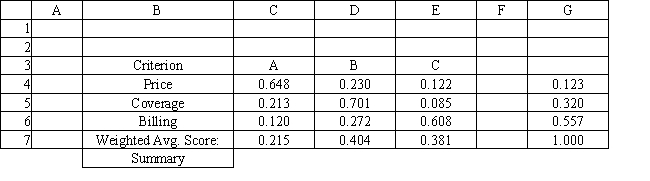

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

-Expected regret is also called

Definitions:

Portfolio

A collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including mutual funds and ETFs, held by an individual or an institution.

Risk Aversion

The preference to avoid uncertainty and potential loss in investment decisions, favoring safer or less volatile investments.

Historical Standard Deviation

It measures the variability or dispersion of historical returns of an investment around its average return over a certain period, indicating the investment's risk level.

Expected Return

The predicted average return on an investment calculated by adding together all possible returns weighted by the likelihood of each occurring.

Q10: Refer to Exhibit 14.5. What is the

Q26: Process evaluations of compensation programs focus on

Q41: Currently, courts in _ have the authority

Q45: Refer to Exhibit 14.4. What is the

Q50: The most common type of kidnapping case

Q51: In discriminant analysis the averages for the

Q58: Refer to Exhibit 15.2. What formula is

Q64: Refer to Exhibit 13.7. Based on this

Q71: Using the information in Exhibit 12.3, what

Q82: In decision analysis, good decisions<br>A) always result