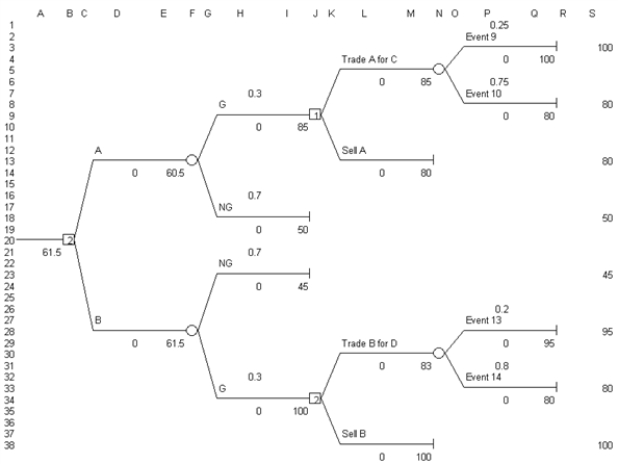

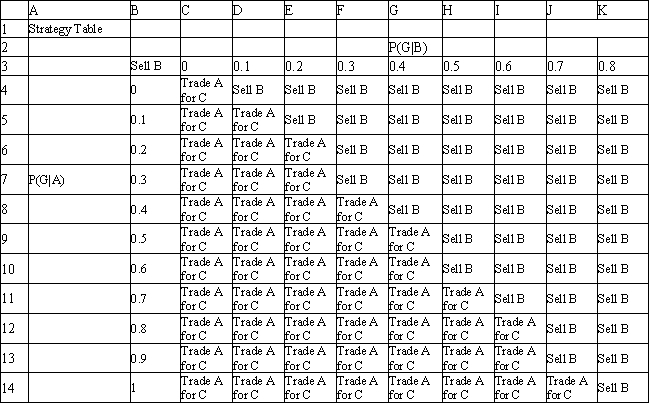

Exhibit 14.14

The following questions use the Decision Tree model and strategy table information below.

-An investor is considering 2 investments, A, B, which can be purchased now for $10. There is a 40% chance that investment A will grow rapidly in value and a 60% chance that it will grow slowly. If A grows rapidly the investor can cash it in for $80 or trade it for investment C which has a 25% chance of growing to $100 and a 75% chance of reaching $80. If A grows slowly it is sold for $50. There is a 70% chance that investment B will grow rapidly in value and a 30% chance that it will grow slowly. If B grows rapidly the investor can cash it in for $100 or trade it for investment D which has a 20% chance of growing to $95 and an 80% chance of reaching $80. If B grows slowly it is sold for $45. What is the multistage decision for this investor and what is the EMV for this decision?

Definitions:

Embroidered Textiles

Textiles adorned with designs sewn onto the fabric with thread or yarn, often showcasing intricate patterns or imagery.

Woven Carpets

Textile floor coverings made by interlacing threads or yarns through a variety of techniques; an ancient craft notable for its artistic and cultural significance across many societies.

Sacred Spaces

Places designated for spiritual worship or religious rituals, which may include temples, churches, mosques, and other structures devoted to spiritual or ceremonial purposes.

Narrative Scenes

Artistic representations intended to tell a story, depicting events from literature, history, religion, or everyday life.

Q10: By definition, victim-facilitated burglaries are not break-ins

Q13: What is informal justice and what does

Q16: The lowest level of household gun ownership

Q34: An approach to resolving criminal cases that

Q40: Non-critical activities are distinguished by the presence

Q66: Using the information in Exhibit 12.4, what

Q68: The determination of the MSE-minimizing value of

Q71: Using the information in Exhibit 12.3, what

Q81: Expected regret is also called<br>A) EMV.<br>B) EOL.<br>C)

Q122: Refer to Exhibit 11.7. What are predicted