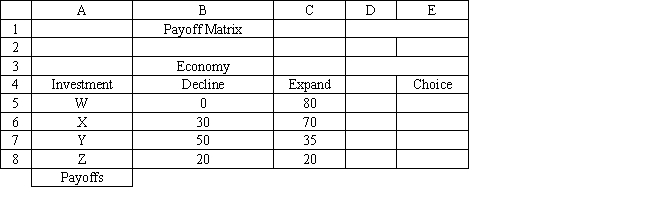

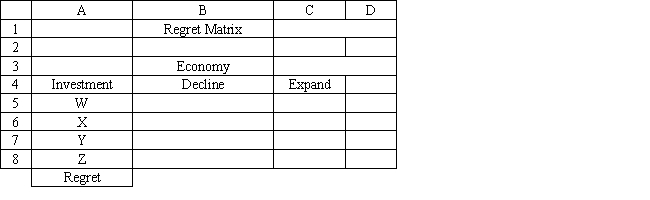

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

-Refer to Exhibit 14.9. The original payoff data is in the worksheet called "Payoffs". What formula should go in cell B5 of this Regret Matrix to compute the regret value?

Definitions:

Spot Rate

The current market price at which a particular currency can be bought or sold for immediate delivery.

Receivable

Amounts owed to a company by its customers or debtors for goods or services delivered that have not yet been paid.

Pooling of Interests Transaction

A method used in accounting for business mergers in which the assets and liabilities of the merging companies are combined using their book values.

Book Value

The net value of a company's assets minus its liabilities, representing the equity value of the company from an accounting perspective.

Q2: What function should be used for generating

Q5: Refer to Exhibit 10.7. What formulas should

Q33: Using the information in Exhibit 12.3, what

Q36: Utilitarian opponents argue high rates of mass

Q36: As an intentional tort, attachment refers to

Q41: Currently, courts in _ have the authority

Q43: A go-between is necessary to facilitate the

Q46: When people fill out a complaint in

Q47: Based on the radar chart of raw

Q49: What is the correct Analytic Solver Platform