A company purchased two new delivery vans for a total of $250,000 on January 1, Year 1. The company paid $40,000 cash and signed a $210,000, 3-year, 8% note for the remaining balance. The note is to be paid in three annual end-of-year payments of $81,487 each, with the first payment on December 31, Year 1. Each payment includes interest on the unpaid balance plus principal.

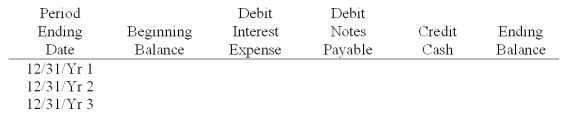

(1) Prepare a note amortization table using the format below:  (2) Prepare the journal entries to record the purchase of the vans on January 1, Year 1 and the second annual installment payment on December 31, Year 2.

(2) Prepare the journal entries to record the purchase of the vans on January 1, Year 1 and the second annual installment payment on December 31, Year 2.

Definitions:

Accumulated Depreciation

The cumulative depreciation of an asset up to a single point in its life, representing the decrease in value due to wear and tear over time.

Cost of Goods Sold

The immediate expenses related to the manufacturing of products which a business sells, covering materials and workforce.

Depreciation Expense

An accounting method to allocate the cost of a tangible or physical asset over its useful life.

Net Income

The total profit of a company after all expenses and taxes have been subtracted from total revenue; often called the bottom line.

Q3: A company issued 8%, 15-year bonds with

Q4: Vans purchased 40,000 shares of Skechs common

Q6: Partners' withdrawals of assets are:<br>A) Credited to

Q35: Partner return on equity is calculated as

Q36: On January 1, $300,000 of par value

Q88: Short-term investments:<br>A) Are securities that management intends

Q95: _ bonds can be exchanged for a

Q126: A bank that is authorized to accept

Q127: Foreign exchange rates fluctuate due to many

Q210: Explain where each of the following items