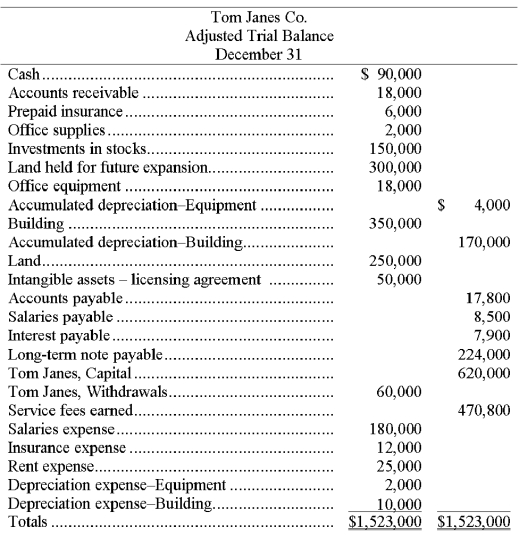

The following year-end adjusted trial balance is for Tom Janes Co. at the end of December 31. The credit balance in Tom Janes, Capital at the beginning of the year, January 1, was $320,000. The owner, Tom Janes, invested an additional $300,000 during the current year. The land held for future expansion was also purchased during the current year.  Required: 1. Prepare a classified year-end balance sheet. (Note: A $22,000 installment on the long-term note payable is due within one year.)

Required: 1. Prepare a classified year-end balance sheet. (Note: A $22,000 installment on the long-term note payable is due within one year.)

2. Using the information presented:

(a) Calculate the current ratio. Comment on the ability of Tom Janes Co. to meets its short-term debts.

(b) Calculate the debt ratio and comment on the financial position and risk analysis of Tom Janes Co.

(c) Using the account balances to analyze the financial position of Tom Janes Co., why would the owner need to invest an additional $300,000 in the business when the business is already profitable and the owner had an existing capital balance of $320,000?

Definitions:

Article I, Section 8

A section of the United States Constitution that outlines the enumerated powers of Congress, including the authority to tax, regulate interstate commerce, and maintain armed forces.

Necessary and Proper

A clause in the U.S. Constitution granting Congress the power to pass all laws deemed necessary and proper for carrying out its enumerated powers.

XYZ Affair

A diplomatic incident between France and the United States in 1797-98, which led to an undeclared naval war, caused by French demands for bribes from American negotiators.

Domestic Political Ramifications

The consequences or effects on a country's internal politics resulting from specific actions, policies, or events.

Q5: A debit is used to record:<br>A) A

Q15: All necessary numbers to prepare the balance

Q48: An asset created by prepayment of an

Q57: A _ inventory system updates the accounting

Q60: A company purchased $1,800 of merchandise on

Q79: Show the December 31 adjusting entry to

Q84: What is the difference between the periodic

Q118: Josephine's Bakery had the following assets and

Q160: Reversing entries:<br>A) Are optional.<br>B) Are mandatory.<br>C) Correct

Q161: Identify and explain the key components of