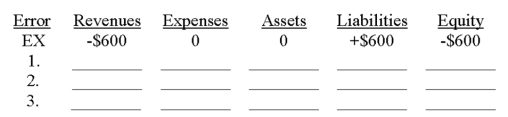

Given the table below, indicate the impact of the following errors made during the adjusting entry process. Use a "+" followed by the amount for overstatements, a "-" followed by the amount for understatements, and a "0" for no effect. The first one is done as an example.

Ex. Failed to recognize that $600 of unearned revenues, previously recorded as liabilities, had been earned by year-end.

1. Failed to accrue salaries expense of $1,200.

2. Forgot to record $2,700 of depreciation on office equipment.

3. Failed to accrue $300 of interest on a note receivable.

Definitions:

ROI Calculation

A financial metric used to evaluate the efficiency and profitability of an investment, calculated as the return on investment divided by the cost of the investment.

Financial Benefits

Economic advantages or gains, such as increased income, cost savings, or improved financial performance.

Utility Analyses

Evaluations intended to measure the effectiveness and economic impact of human resource interventions like training and selection.

Financial Value

The monetary worth or significance of an asset, investment, or transaction.

Q37: On October 1, Mutch Company sold merchandise

Q52: The first step in the accounting cycle

Q83: Given the table below, indicate the impact

Q111: The adjusting entry to record the earned

Q116: Based on the following information from Raptor

Q125: Topflight Company had $1,500 of store supplies

Q145: Explain the purpose of reversing entries.

Q154: The special account used only in the

Q160: Reversing entries:<br>A) Are optional.<br>B) Are mandatory.<br>C) Correct

Q174: All plant assets, including land, eventually wear