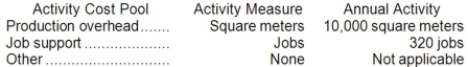

Jackson Painting paints the interiors and exteriors of homes and commercial buildings. The company uses an activity-based costing system for its overhead costs. The company has provided the following data concerning its activity-based costing system.  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

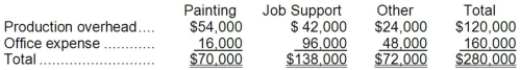

The company has already finished the first stage of the allocation process in which costs were allocated to the activity cost centers. The results are listed below:  Required:

Required:

a. Compute the activity rates (i.e., cost per unit of activity) for the Painting and Job Support activity cost pools. Round off all calculations to the nearest whole cent.

b. Prepare an action analysis report in good form of a job that involves painting 63 square meters and has direct materials and direct labor cost of $2,070. The sales revenue from this job is $2,500.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost; production overhead as a Red cost; and office expense as a Yellow cost.

Definitions:

Stressful Situation

An event or scenario that causes strain or tension, requiring adaptation or response from the individual.

Emotional Distress

Negative feelings and stress that result from challenging situations, often impacting mental health and well-being.

Stress

A psychological and physical response to perceived challenges or threats, resulting in strain or tension.

Realistically Appraising Stress

The process of accurately assessing the sources of stress in one's life and their potential impact.

Q16: Control equation: Need for Action = _

Q21: Orzel Corporation has provided the following data

Q52: If Store B sales increase by $20,000

Q56: Which of the following statements is true

Q67: Stretch goals are _.<br>A) impossible to meet<br>B)

Q79: An organization meets its _ responsibility when

Q90: If a cost must be arbitrarily allocated

Q136: Sturr Market has 3 stores: P, Q,

Q163: The Southern Division's break-even sales is closest

Q228: Under absorption costing, fixed manufacturing overhead is