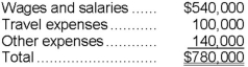

Fife & Jones PLC, a consulting firm, uses an activity-based costing in which there are three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:

Costs:  Distribution of resource consumption:

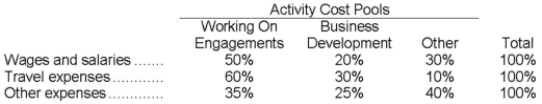

Distribution of resource consumption:  Required:

Required:

a. How much cost, in total, would be allocated to the Working On Engagements activity cost pool?

b. How much cost, in total, would be allocated to the Business Development activity cost pool?

c. How much cost, in total, would be allocated to the Other activity cost pool?

Definitions:

Competitive Advantage

The unique attributes or circumstances that allow a company to produce goods or services better or more cheaply than its competitors.

Strategic Vision

A clear, inspiring long-term goal or direction for an organization, intended to guide its decision-making and strategic planning.

Core Values

Fundamental beliefs or guiding principles that dictate behavior and help individuals understand the difference between right and wrong.

Cultural Audit

An examination of an organization's values, beliefs, and practices to assess its cultural environment and effectiveness.

Q7: Different people have different views of what

Q11: The break-even in monthly unit sales is

Q18: The variable costs for the South area

Q27: Frank Corporation manufacturers a single product that

Q37: Grand Corporation manufactures and sells one product.

Q57: The president of Virtual Products LLC is

Q98: Bianchini Corporation's contribution margin ratio is 58%

Q103: The Consumer Division's break-even sales is closest

Q211: In last year's income statement segmented by

Q230: Yuvil Corporation produces a single product. At