Foradori Corporation's Activity-Based Costing System Has Three Activity Cost Pools-Fabricating

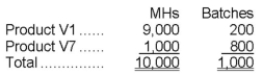

Foradori Corporation's activity-based costing system has three activity cost pools-Fabricating, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:  Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:  Required:

Required:

Calculate activity rates for each activity cost pool using activity-based costing.

Definitions:

Diffuse

To spread or disperse something widely, or to become less concentrated or focused.

Comprehend

To understand or grasp the meaning of something.

Custom-Tailored

Specifically designed or modified to meet the unique needs or preferences of an individual or organization.

Diffuse

To spread or scatter broadly, often used in the context of light, ideas, or substances.

Q14: Griffy Corporation manufactures and sells one product.

Q15: Hasty Hardwood Floors installs oak and other

Q18: Which of the following terms refers to

Q33: Gough Corporation has two divisions: Domestic and

Q38: Super-variable costing is a costing method that

Q53: A(n) _ environment, in which managers make

Q76: Under absorption costing, the unit product cost

Q79: Nelson Corporation, which has only one product,

Q81: How much overhead cost is allocated to

Q158: Gaskey Inc. expects its sales in February