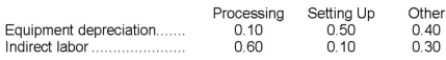

Loader Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $88,000 and indirect labor totals $1,000. Data concerning the distribution of resource consumption across activity cost pools appear below:  Required:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Definitions:

Exploratory Experimentation

The process of conducting tests and investigations with an open-ended approach to discover new knowledge, insights, or solutions.

Prototype

An early sample, model, or release of a product built to test a concept or process, serving as a thing to be replicated or learned from.

Beepi

A now-defunct online marketplace and a platform for buying and selling used cars, known for its innovative approach to vehicle transactions.

Peer-to-Peer

A decentralized model of interaction between parties or individuals directly without the need for intermediaries.

Q1: Redstone Corporation produces a single product and

Q8: The unit product cost under super-variable costing

Q10: The margin of safety as a percentage

Q44: Which of the following refers to the

Q60: Loader Corporation has an activity-based costing system

Q84: _ justice focuses on treating people the

Q114: Assume the company's target profit is $12,000.

Q115: Sidell Inc., which produces a single product,

Q134: All other things the same, an increase

Q139: The company's overall break-even sales is closest