Foradori Corporation's Activity-Based Costing System Has Three Activity Cost Pools-Fabricating

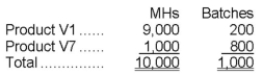

Foradori Corporation's activity-based costing system has three activity cost pools-Fabricating, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:  Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:  Required:

Required:

Calculate activity rates for each activity cost pool using activity-based costing.

Definitions:

Q8: The unit product cost under super-variable costing

Q17: Managers will often allocate common fixed expenses

Q46: _ are managers who are comfortable with

Q49: The step-down method of allocation is simpler

Q50: _ add value to organizations through their

Q59: Which of the following practices should be

Q70: To be effective, the management functions are

Q79: An organization meets its _ responsibility when

Q143: Jimerson Corporation produces a single product and

Q143: Garcia Veterinary Clinic expects the following operating