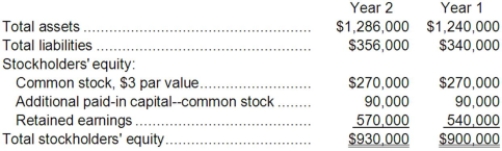

Vogelsberg Corporation has provided the following financial data:  The company's net operating income in Year 2 was $62,308; its interest expense was $12,000; and its net income was $32,700. Dividends on common stock during Year 2 totaled $2,700. The market price of common stock at the end of Year 2 was $6.37 per share.

The company's net operating income in Year 2 was $62,308; its interest expense was $12,000; and its net income was $32,700. Dividends on common stock during Year 2 totaled $2,700. The market price of common stock at the end of Year 2 was $6.37 per share.

Required:

a. What is the company's times interest earned for Year 2?

b. What is the company's debt-to-equity ratio at the end of Year 2?

c. What is the company's equity multiplier at the end of Year 2?

d. What is the company's earnings per share for Year 2?

e. What is the company's price-earnings ratio for Year 2?

f. What is the company's dividend payout ratio for Year 2?

g. What is the company's dividend yield ratio for Year 2?

h. What is the company's book value per share at the end of Year 2?

Definitions:

Costs

The monetary value required to produce goods or services, including materials, labor, and overhead expenses.

Direct Labor

The labor costs directly associated with the manufacture of products or the provision of services, including wages of workers who can be directly linked to specific goods or services.

Variable Factory Overhead

Costs that fluctuate with the level of production, such as utilities and materials used in the manufacturing process.

Direct Labor Cost

The total cost of all labor that can be directly attributed to the manufacturing or production of goods or services.

Q12: The net cash provided (used) by financing

Q12: Spomer Corporation's inventory at the end of

Q68: (Ignore income taxes in this problem.) Jason

Q73: The company is considering launching a new

Q84: Accounts receivable turnover will normally decrease as

Q84: Crabill Corporation has provided the following information

Q87: The working capital at the end of

Q99: The total cash flow net of income

Q148: Windham Corporation has current assets of $400,000

Q210: If current assets exceed current liabilities, prepaying