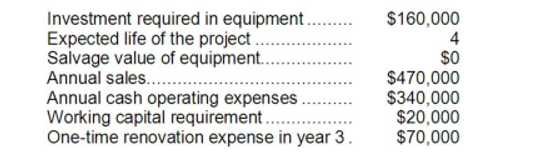

Pont Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Health Concerns

Issues or conditions related to the maintenance of physical, mental, and social well-being.

Health-Impairing Habits

Behaviors or practices detrimental to one's health, such as smoking, excessive alcohol consumption, or a poor diet.

Workout

A session of physical exercise designed to improve fitness, strength, or endurance.

Pleasant Activities

Activities that provide enjoyment, satisfaction, or relaxation, contributing to an individual's wellbeing.

Q11: For performance evaluation purposes, any variance between

Q38: Under the direct method of determining the

Q40: Eliminating nonproductive processing time is particularly important

Q42: How much actual Order Fulfillment Department cost

Q88: The income tax expense in year 3

Q127: Tomlin Corporation prepares its statement of cash

Q129: (Ignore income taxes in this problem.) Consider

Q189: Sand Company has an acid-test ratio of

Q193: The company's equity multiplier at the end

Q212: Weightman Corporation's net operating income in Year