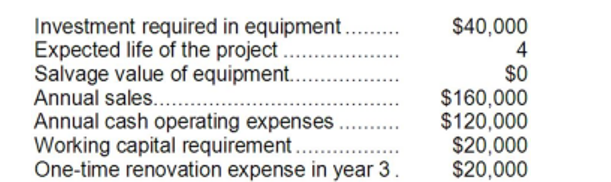

Shinabery Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

Definitions:

New Ventures

Businesses or projects initiated by entrepreneurs, often characterized by innovation, high risks, and high rewards.

Opportunity Costs

The cost of forgoing the next best alternative when making a decision, representing the benefits one could have received by taking an alternative action.

Sunk Costs

Expenses that have been spent and cannot be retrieved.

Cash Flow Estimation

This refers to the process of forecasting and evaluating the amount of cash that is expected to flow into and out of a business over a specific period.

Q47: Jessel Corporation has provided the following information

Q50: The company has received a special, one-time-only

Q51: In a decision to drop a segment,

Q79: Diss Corporation is considering a capital budgeting

Q83: Dul Corporation has provided the following data

Q102: The total cash flow net of income

Q113: Schoultz Corporation has provided the following data

Q130: The income tax expense in year 2

Q155: (Ignore income taxes in this problem.) Naomi

Q160: If the project profitability index of an