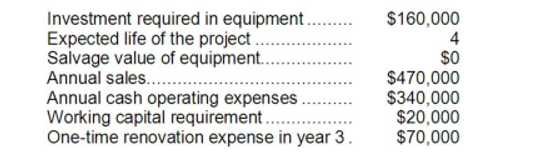

Pont Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

Definitions:

Routine Behaviors

Actions that individuals perform regularly in a habitual manner.

Decision Making

The process of choosing among different alternatives or options to achieve a desired outcome or solve a problem.

Zappos

An online retailer known for its extensive selection of shoes and clothing, notable for its exceptional customer service and company culture that emphasizes employee happiness and satisfaction.

Odd Interview Questions

Odd interview questions are unconventional queries posed to candidates to assess their creativity, problem-solving ability, and adaptability.

Q4: Ignoring the cash inflows, to the nearest

Q7: Sales dollars is generally a poor base

Q16: Mujalli Corporation is considering a capital budgeting

Q59: Globe Manufacturing Company has just obtained a

Q73: The net cash provided by (used in)

Q95: Which project has the highest ranking according

Q115: The net present value of the entire

Q143: (Ignore income taxes in this problem.) Galindo

Q159: The formula for the times interest earned

Q267: Neelty Corporation has interest expense of $16,000,