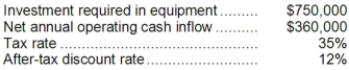

Depew Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $250,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $250,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Nephropathy

Damage or disease affecting the kidneys.

Hydroureter

The dilation or swelling of the ureter due to the accumulation of urine, often resulting from obstruction or blockage.

Storing Urine

The function of the urinary bladder, which is to hold urine until it is excreted from the body.

Urinary Bladder

A hollow muscular organ in the pelvic area of the body that collects urine excreted by the kidneys before disposal by urination.

Q8: The payback period for the investment is

Q24: Suppose there is not enough idle capacity

Q34: The total cash flow net of income

Q45: Degollado Corporation's most recent income statement appears

Q52: The net present value of the entire

Q53: The project profitability index is used to

Q62: Adamyan Co. manufactures and sells medals for

Q63: When used in return on investment (ROI)

Q108: The total cash flow net of income

Q261: The company's times interest earned for Year