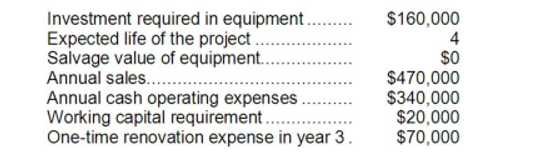

Pont Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

Definitions:

Adaptive Behavior

Actions or skills that a person learns and uses to adjust to or manage their surroundings and everyday life effectively.

Bayley-III

The third edition of the Bayley Scales of Infant and Toddler Development, a comprehensive tool used to assess the developmental functioning of infants and young children.

Stimulus

Any external event or situation that influences an individual's sensory input and can elicit a physiological or psychological response.

Bayley Scales

A series of standardized tests used primarily to assess the motor (fine and gross), cognitive, and language development of infants and toddlers, ranging from birth to 3 years old.

Q20: The income tax expense in year 2

Q36: (Ignore income taxes in this problem.) The

Q41: Digby Corporation's balance sheet and income statement

Q64: (Ignore income taxes in this problem.) Dunay

Q128: An investment project with a project profitability

Q163: Ignoring any salvage value, to the nearest

Q176: The company's current ratio at the end

Q178: Yukon Perfume Corporation manufactures three distinct perfumes

Q247: Brill Corporation has provided the following financial

Q278: Feiler Corporation has total current assets of