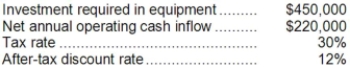

Brodigan Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $150,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $150,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

FMVSS-121 Redundancy

A redundancy requirement specified in the Federal Motor Vehicle Safety Standards (FMVSS) 121, pertaining to the air brake systems in heavy vehicles, ensuring the system’s effectiveness even when part of it fails.

Pneumatic

In truck technology this term is used mainly to describe chassis air under pressure, as in pneumatic brakes or pneumatic suspension.

Yaw

Vehicle lateral tracking off the intended straight-ahead or turning radius; a vehicle traveling sideways in a skid would be an extreme case of yaw.

Wheelbase

Dimension of a tandem drive axle truck measured between the center of the front axle and the centerline of the tandem bogie. In a two-axle vehicle, it is the distance between the centerline of the front and rear axles.

Q28: For performance evaluation purposes, how much of

Q31: Free cash flow will increase if a

Q33: Hauge Corporation is considering a capital budgeting

Q42: The net present value of the entire

Q44: The free cash flow for the year

Q75: The company's total asset turnover for Year

Q97: Which of the following would be added

Q172: Straton Corporation has provided the following financial

Q192: The company's equity multiplier at the end

Q284: Braverman Corporation's net income last year was