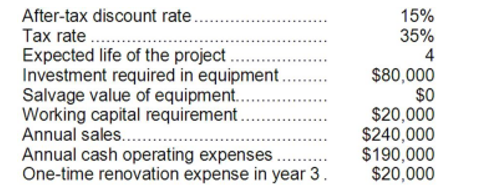

Glasco Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Fuji Canada

Likely a reference to a company or organization operating in Canada associated with the Fuji brand, which could range from photographic and imaging products to other consumer goods.

Leap Year

A year with 366 days, with an extra day added to February to keep the calendar year synchronized with the astronomical or season year; occurs every four years.

Special Promotion

A marketing campaign offering unique deals or discounts to boost sales or consumer interest.

Wholesaler

A person or entity that buys goods in large quantities from manufacturers or importers and sells them to retailers or other businesses.

Q15: Wegener Corporation's most recent balance sheet and

Q23: The accounts receivable turnover for Year 2

Q26: The management of Fannin Corporation is considering

Q64: (Ignore income taxes in this problem.) Dunay

Q78: Pilgrim Corporation makes a range of products.

Q86: Buying property, plant, or equipment would be

Q204: The company's earnings per share for Year

Q238: Pribyl Corporation has provided the following financial

Q259: Shipley Corporation has provided the following

Q279: The company's price-earnings ratio is closest to:<br>A)19.79<br>B)0.51<br>C)8.36<br>D)12.53