Lasater Corporation has provided the following information concerning a capital budgeting project:  The company's tax rate is 35%. The company's after-tax discount rate is 15%. The project would require an investment of $10,000 at the beginning of the project. This working capital would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company's tax rate is 35%. The company's after-tax discount rate is 15%. The project would require an investment of $10,000 at the beginning of the project. This working capital would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

Definitions:

Statute of Frauds

A legal principle requiring certain types of contracts to be executed in writing to be enforceable.

Sale of Goods

A commercial transaction where the ownership of physical products is transferred from the seller to the buyer for a price.

Statute of Frauds

A legal principle requiring certain types of contracts to be in written form in order to be enforceable.

Specific Performance

A legal remedy in contract law where a court orders a party to perform their obligations under a contract, rather than just paying damages for failure to do so.

Q31: Free cash flow will increase if a

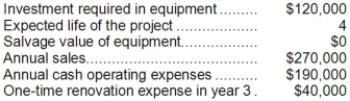

Q34: The management of Leinberger Corporation is considering

Q54: Bosell Corporation has provided the following information

Q57: (Ignore income taxes in this problem.) The

Q59: (Ignore income taxes in this problem.) Peter

Q92: The company's debt-to-equity ratio at the end

Q92: The net cash provided by (used in)

Q115: The net cash provided by (used in)

Q176: The company's current ratio at the end

Q183: At what selling price would the new