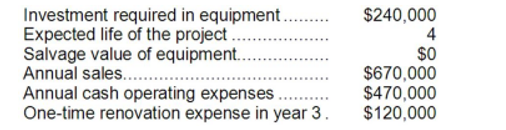

Foucault Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Strategic Framework

An overarching structure that guides the planning and decision-making processes within an organization.

Compensation

Financial and non-financial rewards given to employees in exchange for their work and service.

Textbook

A book containing comprehensive and authoritative information on a specific subject, intended primarily for academic study.

Contextual Variables

External or environmental factors that influence the performance or behavior of individuals or organizations.

Q18: Excerpts from Deblois Corporation's comparative balance sheet

Q35: Bierly Corporation has two operating divisions--an Atlantic

Q62: Adamyan Co. manufactures and sells medals for

Q121: The net present value of the entire

Q132: The company's return on total assets for

Q159: Assume that dropping Product G will have

Q167: (Ignore income taxes in this problem.) Ataxia

Q173: Walker Corporation has provided the following financial

Q278: Feiler Corporation has total current assets of

Q286: Financial statements for Praeger Corporation appear below: