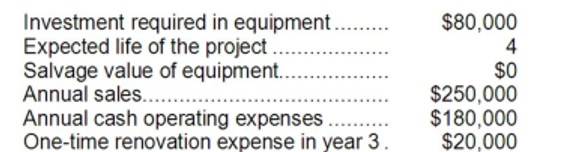

Credit Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Disparate Treatment

Refers to unequal behavior towards an individual or group based on protected characteristics such as race, age, or gender, violating anti-discrimination laws.

Title VII

A section of the Civil Rights Act of 1964 prohibiting employment discrimination based on race, color, religion, sex, or national origin.

Basis of Race

A consideration or judgement made regarding individuals or groups specifically related to their racial background.

Punitive Damages

Monetary compensation awarded in court cases that goes beyond what the plaintiff actually lost, intended to punish the defendant for particularly egregious conduct.

Q14: Preference decisions follow screening decisions and seek

Q21: Opportunity cost should be ignored in setting

Q23: The net present value and internal rate

Q32: Rank the products in order of their

Q50: If a project does not have constant

Q55: On its statement of cash flows, what

Q65: The simple rate of return would be

Q66: Maraby Corporation's inventory turnover for Year 2

Q146: The income tax expense in year 2

Q217: Natcher Corporation's accounts receivable at the end