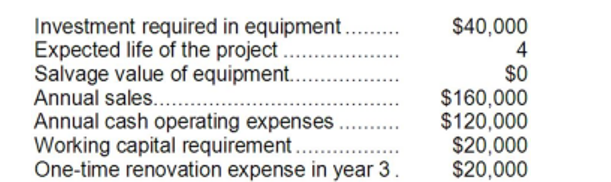

Shinabery Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Communication Budget

The financial allocation for all communication and promotional activities within a company, including advertising, public relations, and direct marketing.

Objective-and-task

A method of budget setting in marketing that involves defining specific objectives and then determining the tasks necessary to achieve these objectives.

Director of Marketing

A senior executive responsible for leading and managing marketing strategies, activities, and goals of a company.

Click-through Rate

A metric that measures the number of clicks advertisers receive on their ads per number of impressions.

Q4: The selling division in a transfer pricing

Q7: The net cash provided by (used in)

Q20: Suppose that Division A has ample idle

Q42: Last year Anderson Corporation reported a cost

Q48: In a statement of cash flows, the

Q61: (Ignore income taxes in this problem.) Sturn

Q72: Clayborn Corporation's net cash provided by operating

Q83: Joint costs are relevant in the decision

Q104: The company's gross margin percentage for Year

Q194: Abdool Corporation has provided the following financial