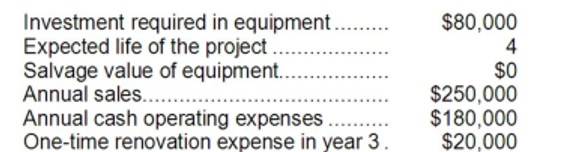

Credit Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

Definitions:

Q1: Illies Corporation's comparative balance sheet appears below:

Q3: (Ignore income taxes in this problem.) The

Q8: The company's working capital at the end

Q63: The net cash provided by (used in)

Q75: A study has been conducted to determine

Q99: The internal rate of return is computed

Q117: Negative free cash flow does not automatically

Q122: The problem requirement does not indicate whether

Q137: Two products, LB and NH, emerge from

Q162: (Ignore income taxes in this problem.) Tidwell