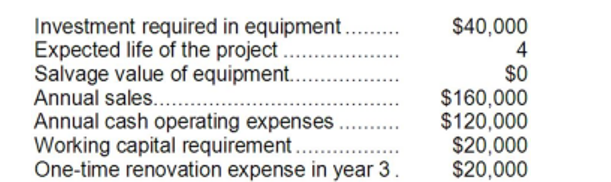

Shinabery Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

Definitions:

Walk Backward

The ability to move in a reverse direction by taking steps with the back leading, typically developed in early childhood.

Biological Transmission

The process of passing biological traits or diseases from one generation to the next through genetic information.

Genes

Units of heredity made up of DNA, located in chromosomes, that determine specific characteristics by coding for proteins.

Traits

Characteristic patterns of thoughts, feelings, or behaviors that are relatively stable over time and across situations.

Q5: Santistevan Corporation has provided the following information

Q7: The inventory turnover for Year 2 is

Q8: The net cash provided by financing activities

Q14: Zucker Corporation has provided the following information

Q30: For performance evaluation purposes, how much of

Q36: Molima Corporation has provided the following information

Q40: Eliminating nonproductive processing time is particularly important

Q47: Maloney Corporation's balance sheet and income statement

Q124: (Ignore income taxes in this problem.) Tangen

Q178: Narstad Corporation's times interest earned for Year