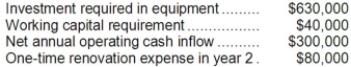

Mota Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 35%. The after-tax discount rate is 15%. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 35%. The after-tax discount rate is 15%. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Corporate Alternative Minimum Tax

A parallel tax system aimed at ensuring that corporations pay at least a minimum amount of tax, regardless of deductions or credits that would otherwise lower their tax bill.

Exemption Amount

This refers to a specific dollar amount that taxpayers can claim for themselves and their dependents to reduce taxable income.

Parent-Subsidiary Group

A group consisting of a parent company and one or more subsidiaries, which are companies controlled by the parent company.

Common Parent Corporation

A corporation that holds a controlling interest in subsidiary companies, forming a corporate group or family.

Q13: Which of the following is correct regarding

Q14: Preference decisions follow screening decisions and seek

Q26: How much Maintenance Department cost should be

Q38: Under the direct method of determining the

Q44: The income tax expense in year 3

Q47: How much Health Care variable cost should

Q99: The following events occurred last year for

Q107: Kaeser Corporation's most recent balance sheet appears

Q129: Tish Corporation produces a part used in

Q177: When a company has a production constraint,