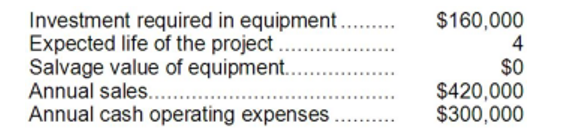

Voelkel Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Normal Population Variances

The variances of populations that follow a normal (Gaussian) distribution.

F-Distribution

A statistical distribution used primarily in the analysis of variance (ANOVA), describing ratios of variance across different datasets.

Random Samples

A sample drawn from a population in such a way that every member of the population has an equal chance of being included.

Level of Significance

The threshold for rejecting the null hypothesis in a statistical test, often set at a value like 0.05 or 0.01.

Q23: How much of the unit product cost

Q27: Freeport Corporation's income statement for last year

Q45: In addition to the facts given above,

Q51: Evita Corporation prepares its statement of cash

Q59: Based solely on the information above, the

Q69: If the equipment is rebuilt, the present

Q85: In a sell or process further decision,

Q110: The income tax expense in year 3

Q139: Zuppa Corporation currently maintains its own printing

Q192: The company's equity multiplier at the end