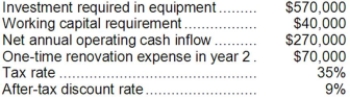

Soffer Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $190,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $190,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

UPA

The Uniform Partnership Act (UPA) is a set of laws adopted by many states in the U.S. to govern the operation of partnerships and the relationship between partners.

Partnership Assets

The resources and property owned by a partnership that are used for conducting its business activities.

Liabilities Priority

The order in which obligations or debts of a company or individual are to be paid if there are insufficient assets to pay all liabilities in full.

Fraudulent Act

refers to any deliberate deception intended to secure an unfair or unlawful gain, or to deprive a victim of a legal right.

Q6: (Ignore income taxes in this problem.) The

Q20: Under the direct method of determining the

Q27: Vinup Corporation has provided the following data

Q34: If a company has computed a project

Q69: If the equipment is rebuilt, the present

Q94: The net present value on this investment

Q102: Suppose a company evaluates divisional performance using

Q117: The management of Bercegeay Corporation is considering

Q148: A customer has requested that Gamba Corporation

Q156: The constraint at Fulena Inc. is an