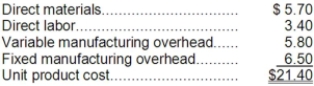

A customer has requested that Gamba Corporation fill a special order for 3,000 units of product Q41 for $25.00 a unit. While the product would be modified slightly for the special order, product Q41's normal unit product cost is $21.40:  Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product Q41 that would increase the variable costs by $7.00 per unit and that would require an investment of $15,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. If the special order is accepted, the company's overall net operating income would increase (decrease) by:

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product Q41 that would increase the variable costs by $7.00 per unit and that would require an investment of $15,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. If the special order is accepted, the company's overall net operating income would increase (decrease) by:

Definitions:

Predetermined Overhead Rate

An estimated overhead cost rate used in cost accounting to allocate overhead expenses to products or job orders.

Direct Labor Costs

Compensation and perks given to workers directly engaged in creating products or services.

Fixed Overhead

Regular, unchanged costs associated with operating a business, such as rent and salaries, irrespective of production levels.

Work in Process

Goods that are in various stages of completion in the manufacturing process but are not yet finished products.

Q23: The net present value and internal rate

Q51: Hosang Corporation has two operating divisions--an Atlantic

Q67: The income tax expense in year 2

Q67: Adah Corporation prepares its statement of cash

Q70: Operating assets include cash, accounts receivable, and

Q102: Dori Castings is a job order shop

Q115: The net present value of the entire

Q125: Hal currently works as the fry guy

Q140: The variance that is usually most useful

Q173: Which product makes the MOST profitable use