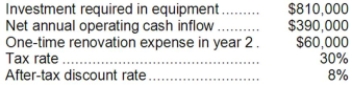

Holzner Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $270,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $270,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Color-Deficient

A condition where an individual has a reduced ability to see color or differences in color.

Functioning Cones

Photoreceptor cells in the retina of the eye responsible for color vision and function best in relatively bright light.

Black and White

Often used to describe situations that are viewed in terms of two clear, opposing positions or choices, with no gray areas in between.

Dim Light

A lighting condition characterized by a low level of illumination, often creating a subdued or intimate atmosphere.

Q5: For performance evaluation purposes, the lump-sum amount

Q17: (Ignore income taxes in this problem.) Janes,

Q30: Albertine Co. manufactures and sells trophies for

Q41: Digby Corporation's balance sheet and income statement

Q84: Which of the following would be considered

Q94: The net present value of the entire

Q106: The Gomez Corporation is considering two projects,

Q109: The net present value of the entire

Q126: The net present value of an investment

Q133: What would be the effect on the