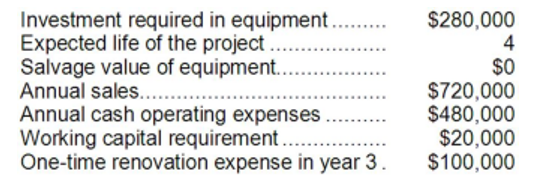

Erling Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

Definitions:

Insurance Market

The marketplace where individuals or entities can purchase insurance products to transfer risk from themselves to an insurance provider.

Adverse Selection

A situation in which one party in a transaction has more or better information than the other, leading to an imbalance that can result in market inefficiency or failure.

Insurance Premium

The amount of money an individual or organization pays for an insurance policy, providing coverage against specific risks over a defined period.

Expected Loss

a calculation used in finance and insurance to estimate the average financial loss or cost associated with an investment or insurance policy over a period.

Q21: Layton Company operates a free day-care center

Q34: An increase in accounts receivable of $1,000

Q40: If accounts receivable increase during a period,

Q51: Fimbrez Corporation has provided the following data

Q67: Goldsmith Corporation has provided the following

Q82: (Ignore income taxes in this problem.) The

Q84: Which of the following would be considered

Q100: Costs associated with two alternatives, code-named Q

Q121: The net cash provided by (used in)

Q238: Pribyl Corporation has provided the following financial