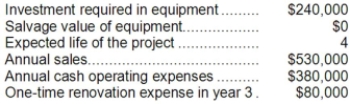

Bosell Corporation has provided the following information concerning a capital budgeting project:  The income tax rate is 30%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The income tax rate is 30%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

Definitions:

Credit Sales

Sales made by a business where payment is delayed and allowed on credit.

Total Sales

The aggregate revenue a company generates from selling its products or services within a specific period.

Cash Received

This refers to the actual amount of cash that a company collects from its business activities, including sales, financing, and investing activities.

Credit Sales

Credit sales are transactions where the goods or services are provided to the customer with the arrangement to pay at a later date.

Q3: The net present value of the entire

Q33: Dukas Corporation's net cash provided by operating

Q64: Vandy Corporation's balance sheet and income statement

Q77: Cutsinger Corporation has provided the following

Q102: The total cash flow net of income

Q115: The net present value of the entire

Q173: Walker Corporation has provided the following financial

Q191: The company's average collection period (age of

Q201: Groeneweg Corporation has provided the following data:

Q205: Schepp Corporation has provided the following financial