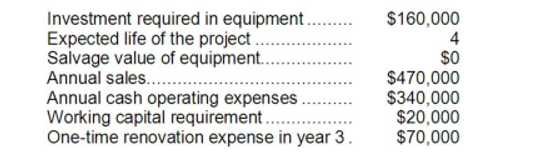

Pont Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 10%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

Definitions:

Conversion Ratio

A ratio set at the time bonds are issued; determines the number of shares that can be exchanged for a bond.

Bond Rating

An evaluation made by credit rating agencies regarding the credit worthiness of a corporation's or government's debt issues, reflecting the likelihood of default.

Yield To Maturity

The total expected return on a bond if held to its maturity date, taking into account both interest payments and capital gains or losses.

Premium

The amount paid for an insurance policy or an additional amount above the nominal or face value of securities.

Q32: Under the simplifying assumptions made in the

Q43: When considering a number of investment projects,

Q65: The simple rate of return would be

Q71: (Ignore income taxes in this problem.) Tranter,

Q123: Narciso Corporation is preparing a bid for

Q141: Smay Corporation has provided the following

Q182: The company's dividend yield ratio is closest

Q205: Schepp Corporation has provided the following financial

Q228: The company's net profit margin percentage for

Q243: The market price of Friden Company's common