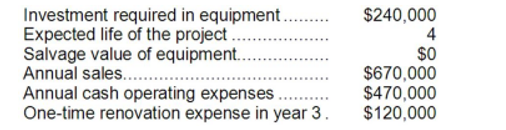

Foucault Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

Definitions:

Average Rate

The mean value of rates over a specified period or under certain conditions.

Mortgage Rate

The interest rate charged on a mortgage, typically expressed as an annual percentage.

GST

Goods and Services Tax, a type of value-added tax imposed on the majority of goods and services that are sold within the country for local use.

Supplies

Materials and goods held for use in the production process or office operations, often considered short-term assets in financial accounting.

Q20: The income tax expense in year 2

Q29: Last year Marton Corporation reported a cost

Q36: Money received from issuing bonds payable would

Q42: How much actual Order Fulfillment Department cost

Q52: Northern Stores is a retailer in the

Q79: The company's average collection period (age of

Q88: Assume that sufficient constraint time is available

Q119: Belk Corporation's balance sheet appears below: <img

Q171: Teich Inc. is considering whether to continue

Q240: Earnings per share is computed by multiplying