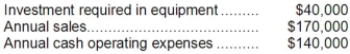

Darnold Corporation has provided the following information concerning a capital budgeting project:  The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 35% and the after-tax discount rate is 9%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $10,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 35% and the after-tax discount rate is 9%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $10,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

Definitions:

Production Function

The representation of the output that a firm can produce with varying combinations of inputs, emphasizing the efficiency and technology used.

Isoquant

A curve that represents all the combinations of inputs that produce the same level of output in production theory.

Output

The aggregate output of merchandise or services generated by a company, sector, or economic system.

Production Function

A mathematical model describing the relationship between the inputs used in production and the resulting output of goods or services.

Q10: The gross margin percentage is computed by

Q10: (Ignore income taxes in this problem.) Alesi

Q39: What would be the effect on the

Q39: The payback period on the new machine

Q58: The gross margin percentage is computed by

Q100: The total cash flow net of income

Q125: Hal currently works as the fry guy

Q165: The simple rate of return on the

Q232: The company's earnings per share for Year

Q265: The company's acid-test (quick) ratio is closest