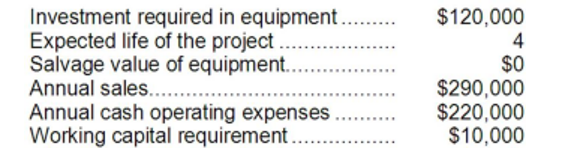

Helfen Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 13%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Echoic Memory

A subtype of sensory memory that retains auditory information for a short period after the original sound is heard.

Fleeting Memory

A brief or rapidly fading memory, often unable to be recalled after a short period of time.

Paying Attention

The act of focusing cognitive resources on a particular stimulus or task, while filtering out distractions.

Professor's Lecture

An educational talk given by a professor to students, usually as part of a university or college course, intended to convey knowledge on a particular subject.

Q30: Under the direct method of determining the

Q53: The total cash flow net of income

Q61: (Ignore income taxes in this problem.) Sturn

Q65: A cost that can be avoided by

Q70: The total cash flow net of income

Q76: Gary Corporation produces products X, Y, and

Q104: Tani Corporation's most recent balance sheet appears

Q133: (Ignore income taxes in this problem) The

Q139: Alopecia Hair Tonic Corporation is considering an

Q161: According to the company's accounting system, what