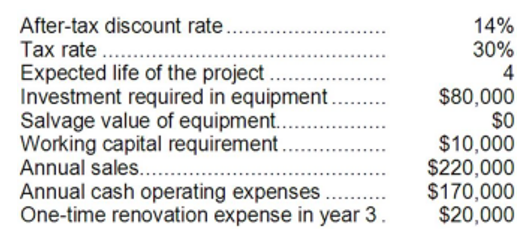

Starrs Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

Definitions:

Distributed Practice

Spacing the study of material to be remembered by including breaks between study periods.

Cramming

An intensive, short-term study technique characterized by long hours of continuous study just before an exam.

Spacing Studying

The practice of distributing learning sessions or practice over time, rather than condensing them into short blocks, to improve long-term memory retention.

Hindsight Bias

The tendency to believe, after an event has occurred, that one would have predicted or expected the event, often referred to as the "I-knew-it-all-along" phenomenon.

Q6: Suppose that Division A is operating at

Q25: Wilson Company maintains a cafeteria for its

Q53: The company's price-earnings ratio for Year 2

Q62: The income tax expense in year 3

Q75: (Ignore income taxes in this problem.) Cascade,

Q78: (Ignore income taxes in this problem.) Mark

Q112: Tempel Corporation has provided the following

Q140: Suppose the special order is for 6,000

Q204: The company's earnings per share for Year

Q249: Karma Corporation has total assets of $190,000