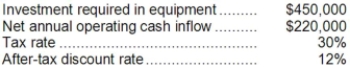

Brodigan Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $150,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $150,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Hostile Takeover

An acquisition attempt by a company or investor to acquire another company against the wishes of the target company's management and board of directors.

Joint Venture

Typically, an agreement between firms to create a separate, co-owned entity established to pursue a joint goal.

Existing Firms

Companies or enterprises that have been established and are currently operative in the marketplace.

Share Rights Plans

Strategic measures employed by companies to ward off hostile takeovers by diluting the value of shares held by potential acquirers.

Q5: In a factory operating at capacity, not

Q8: The higher the discount rate, the lower

Q14: Zucker Corporation has provided the following information

Q27: If Red River can sell 15,000 bags

Q47: If taxes are ignored, all of the

Q58: The total cash flow net of income

Q101: The net present value of the entire

Q107: Two or more products produced from a

Q110: Under the indirect method of determining the

Q200: The accounts receivable turnover for Year 2