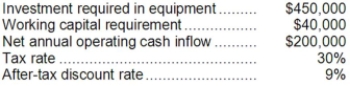

Schlagel Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $150,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $150,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Indirect Method

The indirect method is a way of reporting cash flows from operating activities by starting with net income and adjusting for non-cash transactions.

Capital Structure

The mix of various forms of external funds and equity that a company uses to finance its operations and growth.

Debt Versus Equity

A comparison between using borrowed funds (debt) versus shareholder funds (equity) to finance business operations or growth.

Depreciation

The gradual reduction of the recorded cost of a fixed asset over its useful life.

Q4: Kuma, Inc. had cost of goods sold

Q11: Foster Company makes 20,000 units per year

Q14: Zucker Corporation has provided the following information

Q21: Opportunity cost should be ignored in setting

Q38: The most recent monthly income statement for

Q53: The company's price-earnings ratio for Year 2

Q100: The payback period for the new machine

Q121: Maraby Corporation's current ratio at the end

Q139: Alopecia Hair Tonic Corporation is considering an

Q144: The income tax expense in year 3