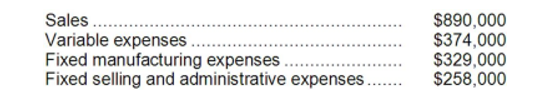

The management of Kabanuck Corporation is considering dropping product V41B. Data from the company's accounting system appear below:

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $184,000 of the fixed manufacturing expenses and $200,000 of the fixed selling and administrative expenses are avoidable if product V41B is discontinued.

-What would be the effect on the company's overall net operating income if product V41B were dropped?

Definitions:

Binding Contract

A legal agreement between parties that is enforceable by law, where each party has specific obligations.

Agreement

A mutual understanding between two or more parties about their respective rights and duties regarding past or future performances.

Offer

An offer is a proposal presented by one party to another with the intention of entering into a binding agreement, subject to acceptance by the receiving party.

Acceptance

In contract law, the expression of assent to the terms of an offer in such a manner that binds both the offeror and the offeree to the terms of the contract.

Q1: Holt Company makes three products in a

Q19: (Ignore income taxes in this problem.) The

Q67: (Ignore income taxes in this problem.) Buy-Rite

Q69: The following standards for variable manufacturing overhead

Q84: The Casket Division of Landazuri Corporation had

Q87: The turnover for Year 1 was:<br>A)10.00<br>B)2.00<br>C)1.50<br>D)3.20

Q94: The net present value of the entire

Q112: Birchett Corporation's most recent balance sheet appears

Q159: The profitability index of investment project E

Q178: Yukon Perfume Corporation manufactures three distinct perfumes